5 Reliable Australian Money Exchange Methods

I think you’ll agree with me when I say money exchange can be complicated and confusing. Even those who transfer money abroad regularly may have difficulty understanding how exchange rates work.

Australian Money Exchange Rate

What is the exchange rate? It is simply the number of units that I need from one currency to buy a unit of another currency.

In Australia, the local currency is the Australian Dollar (also represented by AUD). There is one official exchange rate at any point in time, which changes 24/7. Exchange rates vary due to numerous global economic factors which are out of our control.

For there to be an ‘exchange’ of currency, two parties need to enter into the transaction. I have used the term ‘money dealers’ to describe organisations in the business of exchanging foreign currency.

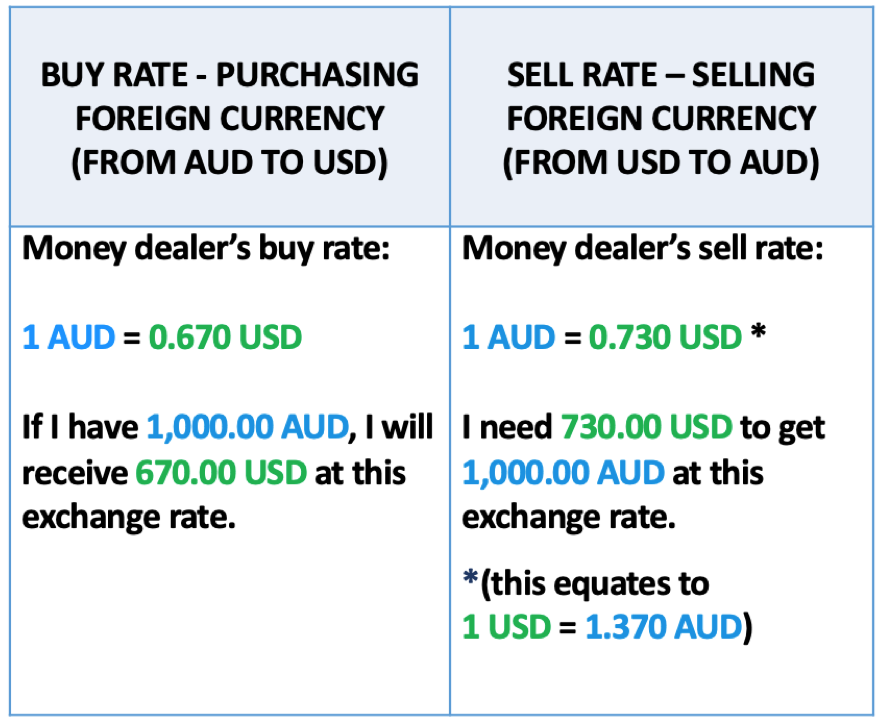

Generally, money dealers will provide you with at least two separate rates of exchange. There is a ‘buying rate’ referring to the rate at which you purchase foreign currency from money dealers. The other is the ‘selling rate’ referring to the rate at which you’re well foreign currency (back) to money dealers rate. The difference between the money dealer’s buy and sell rates and the official exchange rate is usually the profit made by the money dealer form the transaction. However, as the official exchange rate is constantly changing, the buy rate and sell also changes proportionally.

Let me lift the veil for you…

I’ll explain further an example using AUD and US Dollars (USD) with an official exchange rate of 1 AUD = 0.700 USD.

Exchange rate example

From the example, when buying and selling 1,000.00 AUD, the money dealer makes 60.00 USD profit! As a consumer, it means I’m receiving less bang for my buck!!

However, given exchange rates are constantly changing, you can use time (if you have it) by choosing when you do the transaction. This when you can use the money dealer’s competitive rate pricing to help you get the best deal. When the buy rate is high, you should proceed with the transaction to obtain more foreign currency. By locking in that rate, an abrupt change will not take you by surprise and leave you short-changed.

A low rate is an advantage if you are selling the currency to the money dealer. In this way, you need less foreign dollars for every 1 AUD.

Australia Currency.

Name – Australian Dollar.

Symbol: $ Cent: c

Metric Unit: $1=100c

Nicknames: Buck

Coins: Freq Used: $1, $2, 5c, 10c, 20c, 50c

Banknotes: $5, $10, $20, $50, $100

Foreign Money Exchange

I will now explain five of the most common ways to exchange currency. Let me walk you through the pros and cons of money exchange options. From here, you can select the best option to suit your personal needs.

– The Airport

– Banks and Australia Post

– Money exchange service

– Online Money exchange website

– ATM (Automated Teller Machine)

Effectively, what you should look for when exchanging money from one foreign currency to another is the best exchange rate combined with the lowest overall fees.

1. The Airport

Have you ever wondered why popcorn is more expensive at the cinema, drinks cost more at the stadium or even the prices of food inside the entertainment parks are quite high?

Why is that? We pay up to three times more for products just because they are convenient. We could find identical products elsewhere for much lower prices. If you are already here and you don’t have other options around, sound like a good idea right. 😉

I am sure you are with me in this case, when we talk about foreign exchange, it is natural to think of the airport as the first option. It is convenient, being the primary money dealer you see when landing in a new country. However, exchange rates at an airport are likely to be sky-high.

So what’s my point?

If the amount you need to exchange is small, it may be worth paying for the convenience. Nevertheless, you may notice a big difference in your spending money when exchanging a significant amount at the airport.

It may be easy to identify the counterfeit bills of your local currency; however, recognising counterfeit bills of an unknown currency is very difficult. By exchanging the foreign currency in a recognised and supported channels, such as the airport, you reduce this risk.

An option to achieve a competitive rate while being convenient is to order currency online and then collect it from the airport. Depending on the size airport and services provided, you may be able to have options with different money dealers.

Airports provide great convenience and reduced risk of counterfeit currency for money exchange. However, the exchange rates are sky-high; can be up to 15% higher than other alternatives. In conclusion, if you are after convenience with no problem with costs, you can choose this option. But if you are looking to see your exchange into foreign currency go further, the airport should be your last option, especially for more significant transactions.

I know that’s a lot to take in, but bear with me…

2. Banks and Australia Post

I know what you’re thinking; unfortunately, it’s not always as simple as walking into a branch; there are a few things to consider when exchanging money through banks. The first thing you should keep in mind is time. The ability to purchase foreign currency on the spot will depend on the foreign cash holdings of the bank. It is common for foreign currency orders to be placed in advance of when you collect the cash.

All banks have policies and procedures that make the banking system much safer. But as with all banking products, there may be asterisks and fine-print, making the transaction a little more complicated.

Here’s what I mean…

– If you are not a customer of that bank, there may be a limit on the value of the transaction.

– Foreign currency cash fee waivers may only be available to exist customers,

– You may need additional documents to support your transaction

– Limits for buying and selling foreign currency cash may apply

– The advertised retail exchange rate may include a margin (being an additional fee)

If you are looking to buy, you should contact the bank (in person or online) and order in advance. Sometimes they may not have the currency and the amount of that currency in stock. If you are buying currency from one of Australia’s biggest trading partners, such as China, Canada, Indonesia, Japan, New Zealand, USA, UK, Thailand, Singapore, you are more likely to find it easy.

A large number of factors impact the final price, making it challenging to estimate which point of sale offers the best value. What you can do is ask for a quote focused on the amount of money you want to take with you.

These are Australia’s four major banks that you can check the one that best suits you if you prefer this option:

– Commonwealth Bank of Australia

Alternatively, you can also exchange money through Australia Post, which operates a similar online money exchange service to Australian banks.

3. Money Exchange Services

You may be wondering, can I find a money exchange service in Australia? The answer is yes!

They are many money exchange services throughout Australia with most usually located in the larger cities. They are easy to find, just type “money exchange service close to me” into Google. Most currency exchange services have the service fee captured the margin exchange rate. In some cases, an additional fee may also be charged.

You don’t need to buy or order in advance, just the outlet directly which are usually inside a shopping centre or a busy street. Typically these are in tourist areas or places where there are many diasporas such as the local Chinatown.

Currency Exchange outlet

Generally speaking, as, money exchange services are in the sole business of exchanging money, their exchange rates are the best on the market. Whist the exchange rates of the day are defined, they are significantly better than those given at the airport. In some cases, there may be a small fee, but most do not have any additional fees.

As an additional service, if you find a better overall price offered by another foreign exchange retailer, they may beat the price. Also, if you have already made your purchase or they can’t beat the rate, they’ll often refund the difference.

Of course, there are some conditions, but in general, they have a pretty good offer. You can also order them online and pick it up directly at the foreign exchange retailer. Fixing the price and guaranteeing availability.

But wait, there’s more…

4. Online – Money Exchange Websites

Money exchange online is growing in popularity for various reasons:

The exchange rates offered online are often excellent, and you have the advantage of being able to track using an online converter that allows you to track changes and have transparency.

In some cases, you can request home delivery to your home or office, which makes it safer and convenient.

They should not charge you any fee for using the service As their business in online; they can keep their costs down (such as no need to pay rent inexpensive city centres), this allows them to offer competitive prices, low rates and no fees.

Most of them do not facilitate cash transactions; everything is done online; only accept bank transfers don’t accept payment by card.

You need to open an account and have all the details of the bank account in which you will receive the money exchange. They offer a lot of major currencies but is missing other popular currencies.

These are some of the companies dedicated to buying online currencies. You can check if it is available and meets your needs. Among the approximately 180 different types of currency they handle, you may find an option here that suits your needs.

WorldFirst, CurrencyFair, XE, Currencies Direct, Currencycloud, Cambridge Global Payments, Agilityforex and MayfairFX.

5. ATM automated teller machine – International Debit Card

The first thing you should check is that your card supports international transactions. Also, make sure you let your bank know you will use your card overseas to prevent your card from being blocked.

There are different types of cards, some provide significant benefits over others, so it is essential to verify the type of card are you holding.

There is a service called Dynamic Currency Conversion (DCC) which gives you the choice of paying in Australian dollars, rather than the local currency when you make a payment overseas or vice versa. Always chose to be charged in the local currency of the country to avoid wasted money with the change rate

As we saw in the beginning, banks will always use a higher exchange rate. Therefore if you are not using your local bank – the one who gives you offers and benefits, you will be using the ATM of another financial institution which could be more expensive.

ATMs in Australia

So to wrap up…

There are multiple methods to exchange money in Australia. Each of these services has good points and bad points. Which one to use will depend on your circumstances.

– The Airport: is going to be always the expensive one, you’ll pay for the convenience.

– Banks and Australia Post: the ability to purchase foreign currency on the spot will depend on the foreign cash holdings of them.

– Money exchange services: you don’t need to buy or order in advance, they may beat the price if you find a better overall price.

– Online Money exchange website: the exchange rates offered online are often excellent everything is done online; only accept bank transfers.

– ATM (Automated Teller Machine): some provide meaningful advantages over others check which type of card are you holding.

About Rocket Remit

Rocket Remit is the worlds fastest international money transfer service. It allows for sending money from Australia to selected overseas countries instantly at very competitive rates. Use the country selector to choose the country. Click here for more information on how to send money using Rocket Remit.